Aviva AIMS Target Return

The Aviva Irl Multi Strategy Target Return Fund (AIMS) is an outcome-oriented fund aiming to deliver average annual returns of 5 per cent above the European Central Bank base rate (before charges) over a rolling three year period with a target of less than half the volatility of global equities over the same period as measured by MSCI ALL Country World Index Total Return.

This fund is mirroring the Standard Life GARS fund which has been hugely successful in generating consistent steady returns for investors since 2006.

To meet their return target over rolling three-year periods, the fund managers pick diverse strategies that can take views on asset classes, currencies, interest rates and volatility. The managers pick a range of strategies which they expect to work well together whether markets are rising or falling. The Aviva Ireland Multi-Strategy Target Return Fund seeks to deliver returns by identifying investment opportunities across and within asset classes.

The European Securities and Markets Authority (ESMA) rank the risk of a fund from 1 to 7 (low -high risk) on the ESMA risk scale, Aviva expect this fund to be in a ESMA 4 risk category. The volatility of this fund will be very much controlled by Aviva fund Managers.

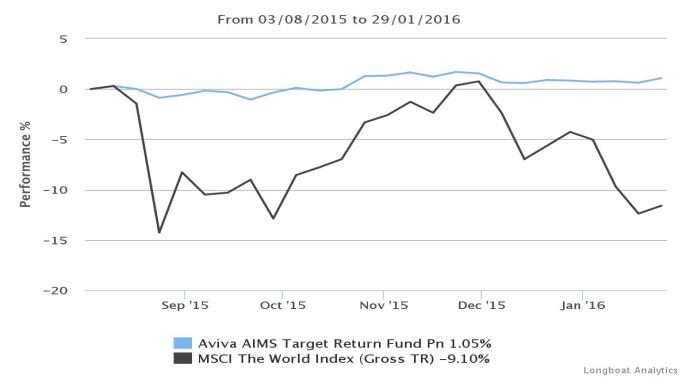

Graph below is based on Gross Fund performance so excludes teh impat of charges and tax.

Safe haven during periods of market volatility

03 August 2015-29 January 2016

Source of Graph:Moneymate Longboat Analytics 3/02/2016

This does not constitute an offer. Please see product brochure for further information and terms and conditions.

Warning: If you invest in this fund you may lose some or all of the money you invest.

Warning: The value of your investment may go down as well as up.